Purple Rain – What happens when someone passes away without a will.

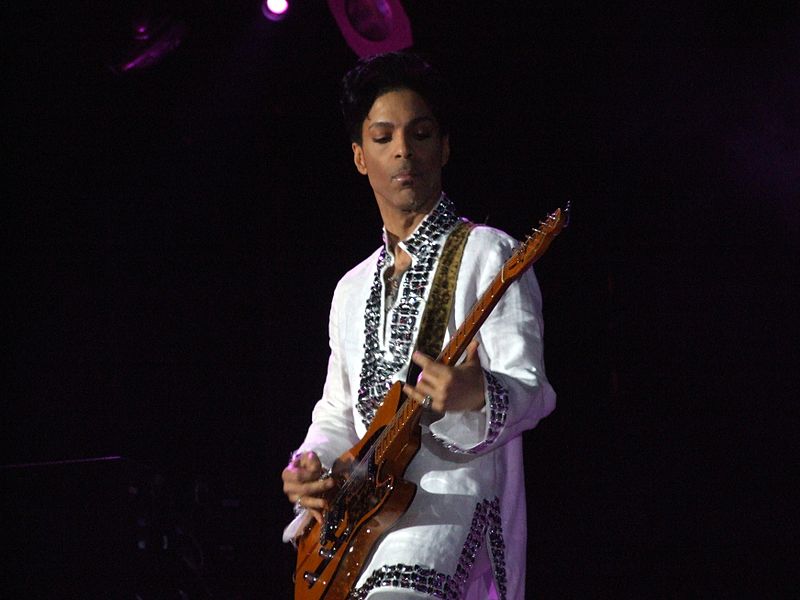

When Prince Rogers Nelson (a/k/a Prince) passed away in Minnesota last year, he died “intestate,” meaning that he died without a Will. Despite a net worth of more than $200 million, Prince provided no direction for his assets, forcing Minnesota courts to determine who will inherit his little red Corvette, raspberry beret, and future music catalog royalties.

When a person dies intestate, Indiana law (like Minnesota law) directs how that person’s assets will be distributed based on a number of factors, including whether the decedent has a surviving spouse, children, parents, or siblings, or any combination of them. For example, a surviving spouse receives the decedent’s entire estate if no parents or children survive; but the spouse receives ¾ if one or both parents survive. If the decedent has no surviving spouse, then any children receive the estate in equal shares. And if the decedent has no surviving spouse or children, then the decedent’s siblings receive the estate in shares. This isn’t the plan most of us would choose!

Because Prince died without a Will and without any surviving spouse, children, or parents, Minnesota courts had to sift through claims from long-lost relatives to determine his lawful heirs. Last week, a Judge ruled that Prince’s heirs are his sister and his five half-siblings. Although these heirs are undoubtedly relieved, they’ll still need to consider estate tax liability.

Indiana repealed its estate tax in 2013, but Minnesota applies a 10-16% tax on estates worth more than Minnesota’s exemption of $1.8 million. There is also a federal estate tax of 18-40% tax on estates worth more than the federal exemption of $5.49 million. So Prince’s $200 million estate will face hefty state and federal tax bills.

While few of us will have an estate worth as much as Prince’s, estate and business succession planning can minimize or eliminate many concerns. Whether you choose a Revocable Trust or rely on a Will, an estate plan can direct asset distribution and reduce the potential for conflicts. Estate taxes also can be minimized or eliminated through long-term lifetime gifts to family members, use of business entities to hold assets, charitable planning, and other planning techniques.

If you would like to meet with one of our estate planning lawyers to discuss your needs, please click here or email us at pcs@stuartlaw.com. We look forward to helping you complete an estate plan that will address your concerns and accomplish your goals.

For more information visit our Wills, Trusts + Estates page.

Photo by: ‘Prince!’ by Scott Penner licenced under CC-BY-SA 2.0

Stuart & Branigin was founded in 1878 in Lafayette, Indiana. Our experienced and knowledgeable lawyers provide trusted counsel to local, regional and national clients. Our firm is composed of five practice groups, Corporate and Non-Profit, Litigation, Personal Injury, Private Client Services, and Transportation.